2241 percent 3095 Total assets - Total equity Total assets 58 Total equity 42 Total assets Net income 13 Total assets. What is the return on equity.

Solved Assume A Firm Has A Debt Equity Ratio Of 62 The Chegg Com

The optimal DE ratio varies.

. An Edmonton firm has a debt-equity ratio of 62 percent a total asset turnover of 139 and a profit margin of 78 percent. If a company produces a return on assets of 14 percent and also a return on equity of 14 percent then the firm. You hold a diversified portfolio consisting of a 10000 investment in each of 15.

This means that for every dollar in equity the firm has 42 cents in leverage. 50159 ROE 051 124 162 ROE 1024. Rate of return a company must earn on its existing assets to maintain the current value of its stock.

What is the amount of the net income. Decrease in the quick ratio An increase in current liabilities will have which one of the following effects all else held constant. The total equity is 511640.

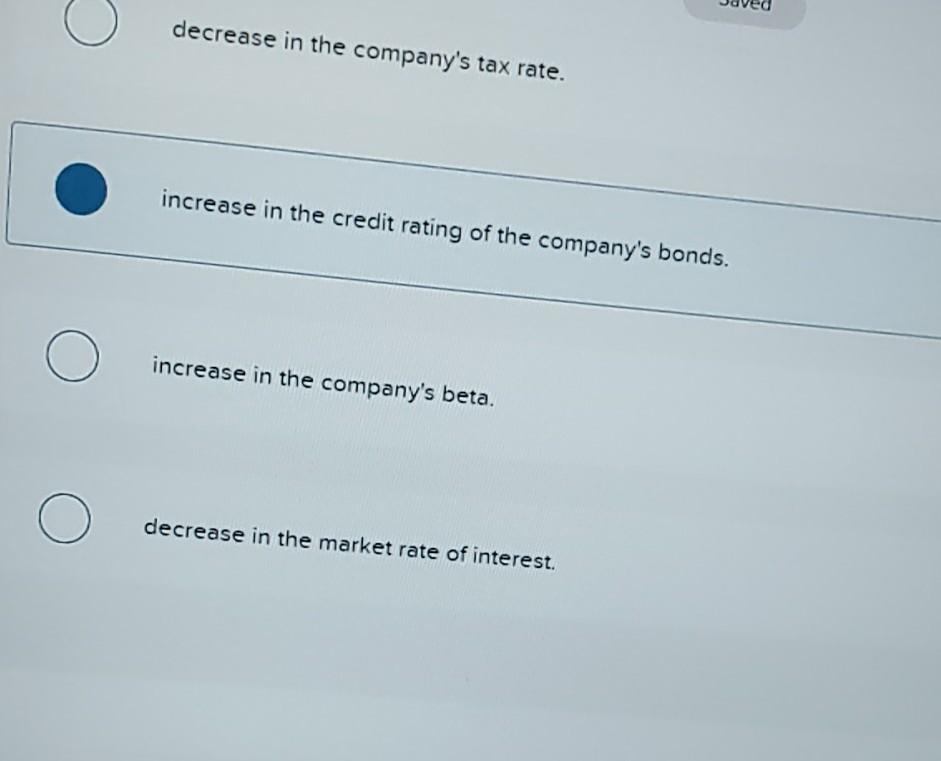

The cost of debt is 5 and the cost of equity is 10. Return on equity 051 124 1 62 1024 Net income 489600 1024 50159. The total equity is 489600.

Debt to Equity Ratio in Practice If as per the balance sheet the total debt of a business is worth 50 million and the total equity is worth 120 million then debt-to-equity is 042. What is the amount of the net income. Hollys is currently an all equity firm that has 9000 shares of stock outstanding at a market price of 45 a share.

The firm is less likely to avoid insolvency in the short run than other firms in the industryC. The total equity is 489600. What is the amount of the net income.

Total asset turnover and debt-equity ratio An increase in which of the following must increase the return on equity all else constant. 100 a firm has a debt equity ratio of 62 a total 100 A firm has a debt-equity ratio of 62 a total asset turnover of 124 and a profit margin of 51 percent. Assume that XYZ Inc.

The total equity is 672100. What is the amount of the net income. The firm has decided to leverage its operations by issuing 120000 of debt at an interest rate of 95 percent.

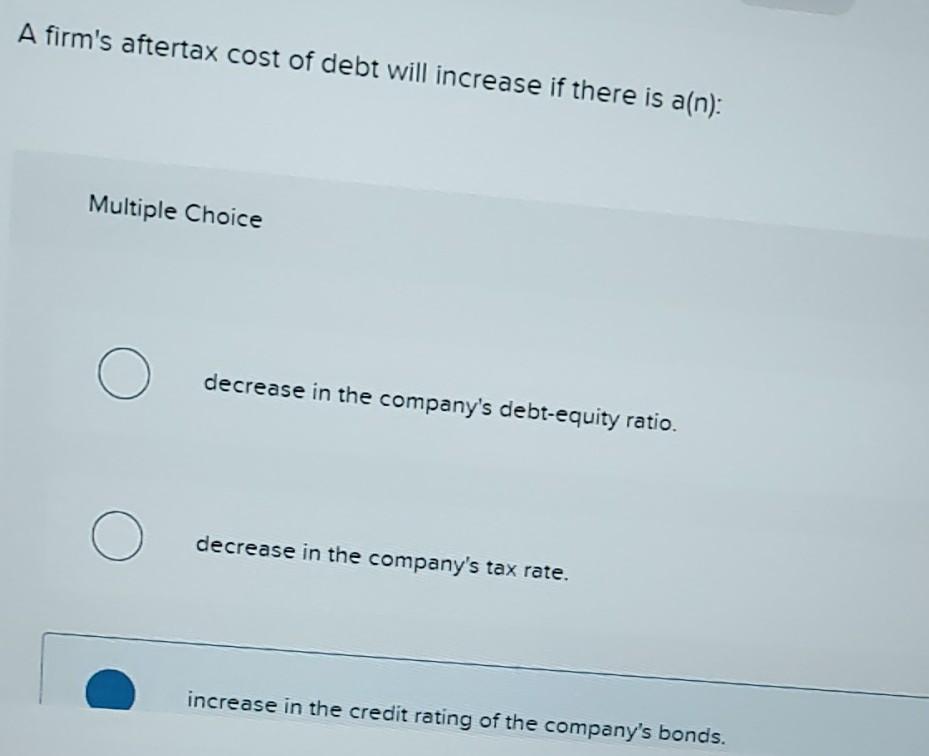

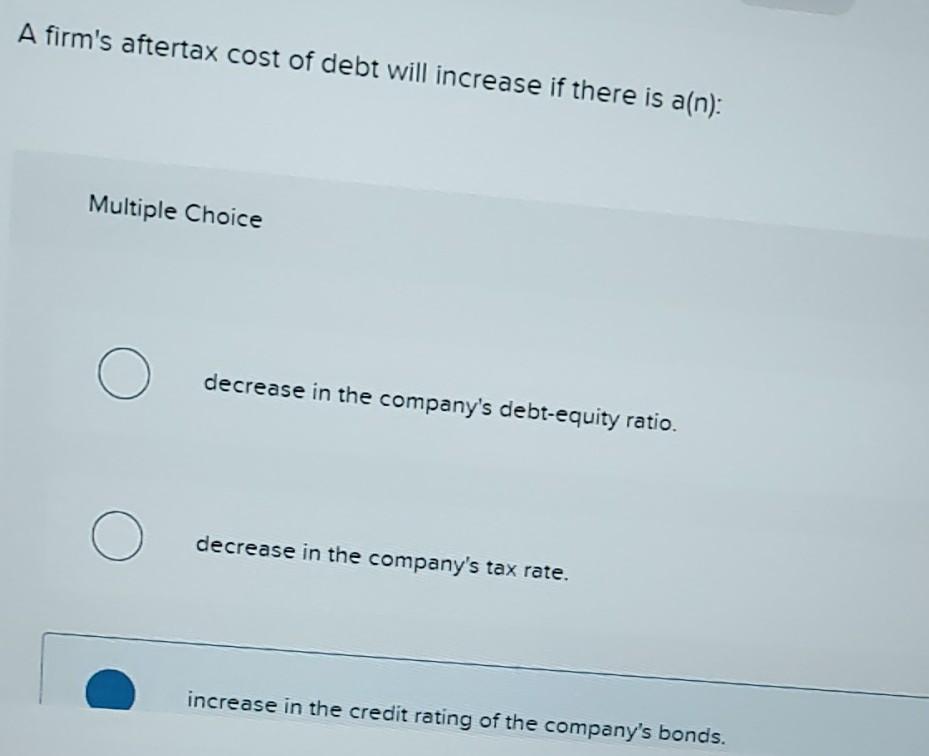

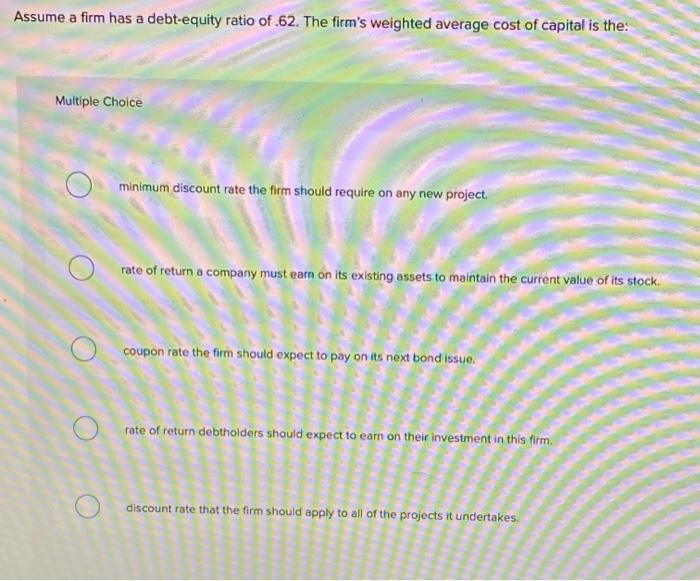

Multiple Choice minimum discount rate the firm should require on any new project. What is the - 16971320. A firm has a debt-equity ratio of 62 percent a total asset turnover of 124 and a profit margin of 51 percent.

Calculate the debt ratio for. A firm has a debt-equity ratio of 62 a total asset turnover of 124 and a profit margin of 51 percent. A firm has a debt-to-equity ratio of 120.

What is the projects NPV2. A firm has a debt-equity ratio of 57 percent a total asset turnover of 112 and a profit margin of 49 percent. A firm with 50 debt to equity ratio has a cost of equity capital of 15 a cost of debt of 9 and a tax rate of 33.

The firm may be more profitable than other firms in the industryD. Assume that your firm has ROA of 171 ROE of 387 and Total Asset Turnover ratio of 275. Enter answer as a ratio-that is do not convert to a percent.

Debt ratio 664 Net profit margin 121 Return on assets ROA 158 Find XYZs Total Asset Turnover ratio. A firm has a debt-to-equity ratio of 1. ROE Profit Margin Total Asset Turnover Equity Multiplier ROE 31 245 120 0911 ROE 91 A firm has a debt-equity ratio of 62 a total asset turnover of 124 and a profit margin of 51 percent.

The firm has a lower PE ratio than other firms in the industryB. The debt ratio is a financial ratio that measures the extent of a companys leverage. Assume a firm has a debt-equity ratio of 62.

The debt ratio is defined as the ratio of total debt to total assets expressed as a decimal or. This new debt will be used. How many sales dollars are being generated per each dollar of assets.

The debt-to-equity ratio is calculated by dividing a corporations total liabilities by its shareholder equity. The firms weighted average cost of capital is the. Since debt equity assets we can determine that there must be 38 of equity per 100 of debt.

The total equity is 489600. The debt-to-equity DE ratio is used to evaluate a companys financial leverage and is calculated by dividing a companys total liabilities. Assume all ratios have positive values.

If there are no taxes or other imperfections what would be its cost of equity if the debt-to-equity ratio were 0. The firm is considering a project costing 5000 that will generate an annual cash flow of 1000 for the next 8 years. This tells us that the firms debtassets 62 or another way of looking at this is that the company is financed by 62 debt.

A firm has a lower quick or acid test ratio than the industry average which implies A. So this tells us that for every 100 of assets there are 62 of debt. The total equity is 489600.

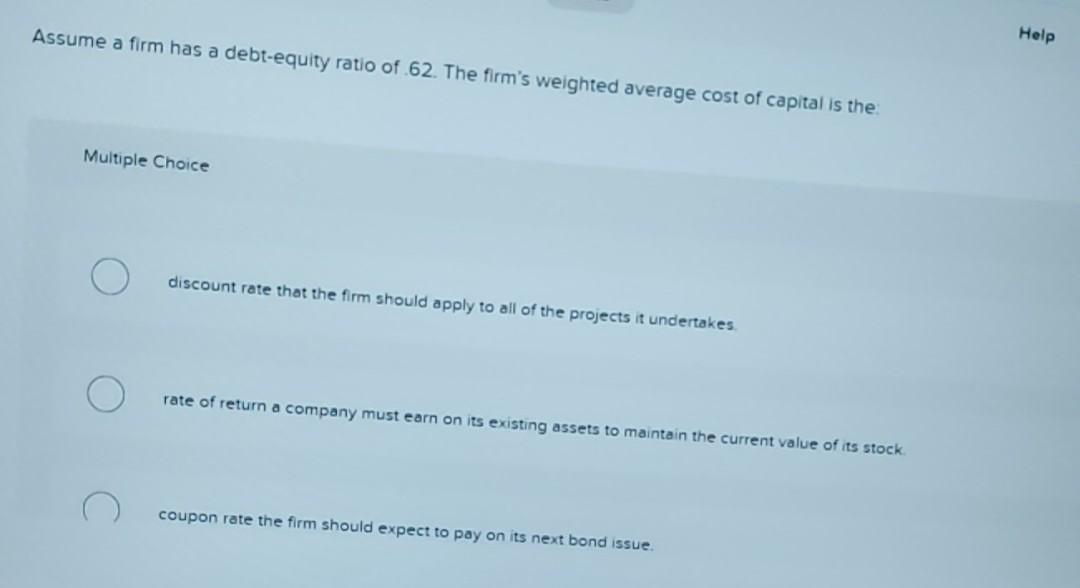

The firms weighted average cost of capital is the Help Multiple Choice discount rate that the firm should apply to all of the projects it undertakes rate of return a company must earn on its existing assets to maintain the current value of its stock coupon rate the firm should expect to pay on its next bond issue. The firm has a lower PE ratio than other firms in the industry and the. What is the amount of the net income.

The MM Company is financed by 4 million market value in debt and 6 million market valuein equity. Coupon rate the firm should expect to pay on its next bond issue. Its cost of equity is 16 and its cost of debt is 8.

A firm has a debt-total asset ratio of 58 percent and a return on total assets of 13 percent. Calculate the weighted average cost of capital.

Solved Assume A Firm Has A Debt Equity Ratio Of 62 The Chegg Com

Solved Kelso S Has A Debt Equity Ratio Of 62 And A Tax Rate Chegg Com

Solved Assume A Firm Has A Debt Equity Ratio Of 62 The Chegg Com

Solved Assume A Firm Has A Debt Equity Ratio Of 62 The Chegg Com

0 Comments